Data Center Support Infrastructure Market by Solution (Power, Cooling, Security), by Service (Consultation, Professional, System Integrator), by End Users (Cloud, Colocation, Enterprise), by Verticals & by Regions - Market Forecasts and Analysis (2014 - 2019)

[163 Pages Report] The global data center support infrastructure market to grow from $27.51 billion in 2014 to $44.44 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 10.1%. Continuously surging demand for data storage and its reliable and efficient processing is impacting the data center infrastructure market, including both Information and Technology (IT) and support. Data center support infrastructure refers to the essential functional systems of a data center, which are helpful in its data storage and processing operations. Majorly the data center support infrastructure comprises of power, cooling, security, and monitoring and measurement systems, which help in up keeping data center core operations of data storage and processing. Across all major industry verticals, business organizations are experiencing enormous data traffic, resulting in significantly high demand for the storage of this information.

In the present scenario, most of the business organizations are facing problem of saturated data center capacity, in terms of power, cooling, and space. To unravel this issue of data storage capacity, companies are either expanding their existing data center capacity or are building new data centers. In both the cases, business organizations will require more support infrastructure for their data centers. This impacts the market for support infrastructure systems of data centers. The market for data center support infrastructure is prevailing since the concept of data centers was realized, but due to advanced technological up-gradations this market is experiencing continuous focus from various vendors.

Some of the key vendors occupying the market are Emerson Network Power, ABB, Eaton, IBM, Schneider Electric, Huawei, HP, Dell, Raritan, and McAfee. The data center support infrastructure market research report discusses the strategies and insights of the key vendors in the industry and also provides in-depth study of driving forces and challenges. The report also analyzes the global trends and future growth potentials across different regions. MarketsandMarkets has segmented the global market by infrastructure type, service, end-user, industry vertical and geographical region.

The report also consists of MarketsandMarkets views of the key players and analysts insights on various developments that are taking place in the data center support infrastructure market space. The forecast period for this market research report is 2014-2019, with 2013 considered as the base year. The research report covers complete market categorized into following sub-markets:

On the basis of type of infrastructure:

- Power

- Power distribution

- UPS

- Generator

- Power storage

- Cabling infrastructure

- Cooling

- Air conditioning

- Chiller

- Economizer

- Cooling tower

- Server/rack cooling

- Monitoring and measurement

- Security

- Physical security

- Logical security

On the basis of service:

- Consultation service

- Professional service

- System integration

On the basis of end-user:

- Cloud provider

- Colocation provider

- Enterprise

On the basis of industry vertical:

- Telecom and Information Technology (IT)

- Banking, Financial Services and Insurance (BFSI)

- Government

- Healthcare

- Energy

- Other vertical

On the basis of geographical region:

- North America (NA)

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America (LA)

In today's era of digitization, data center is considered as the heart of a number of business organizations, storing and processing their critical business information. With continuous growth in mobile communication, social media and broadband, availability and easy accessibility of smart communication devices, rich Internet connectivity, and transformation from maintaining manual to digitized information, the demand for data storage has increased enormously, which in turn has driven the demand for data centers. As the demand for new and retrofit data centers proliferates, the market for both support as well as IT data center infrastructure is also growing.

Data center support infrastructure comprises of four major functional systems including; power, cooling, measurement and monitoring, and security. Exponential growth in the demand for data storage is pushing the business organizations to either enhance the capacity of their existing data centers or build new data centers. Power and cooling contributes to the biggest component of a data centers operational expenses, and with increasing need for data center capacity expansion data center owners and managers are strictly required to reduce the cost associated with the power and cooling of their data center. Also, due to strict government and environmental regulations, data center managers and owners have started focusing on efficient and ecofriendly power and cooling solutions. Monitoring and measurement, and security infrastructure also are of equal importance in any data center, and presents significant opportunity prospect. In the present scenario, the market for traditional data center support infrastructural solutions is experiencing a declining growth, but the growth for efficient and green data center support infrastructure solutions is expected to be significantly high in the coming years.

In this report, MarketsandMarkets provides an in-depth study of the market trends, market sizing, competitive mapping, and market dynamics of the data center support infrastructure market. On the basis of types, global market is broadly segmented into four segments; power, cooling, monitoring and measurement, and security infrastructure. Further, the power infrastructure solutions are categorized into power distribution, Uninterruptible Power Supply (UPS), generator, power storage, and cabling infrastructure solutions. Similarly, cooling infrastructure solutions are categorized into air conditioning, chiller, economizer, cooling tower.

The services in data center support infrastructure market are segmented as consultation services, professional services and system integration services. The global market is also segmented across various geographical regions including North America (NA), Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America (LA).In terms of industry verticals, MarketsandMarkets has segmented the market across telecom and Information Technology (IT), Banking, Financial Services, and Insurance (BFSI),etc. On the basis of type of end users, this market is categorized into cloud providers, colocation providers, and enterprises. North America is expected to remain the major contributor in the market by 2019. However, APAC and Latin America are also expected to emerge as major regions in terms of market size in the next five years, due to rising data center demand. The Telecommunication and IT, and BFSI verticals are expected to hold major share in the total revenue generated in the market.

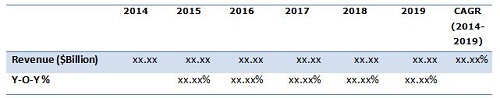

MarketsandMarkets forecasts the global data center support infrastructure market to grow from $27.51 billion in 2014 to $44.44 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 10.1%. The table given below highlights the overall market size and Y-O-Y growth for the forecast period of 2014-2019.

Data Center Support Infrastructure: Market size, 2014 2019 ($Billion, y-o-y %)

Source: Expert Views, Primary Interviews, and MarketsandMarkets Analysis

The figure given below highlights the market size and Y-O-Y growth pattern of the market, for the forecast period from 2014 to 2019.

Table Of Contents

1 Introduction (Page No.- 14)

1.1 Objectives Of The Study

1.2 Markets Covered

1.3 Stakeholders

1.4 Market Scope

2 Research Methodology (Page No.- 17)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Key Data Taken From Secondary Sources

2.2.2 Key Data Taken From Primary Sources

2.2.3 Key Industry Insights

2.2.4 Assumptions

3 Executive Summary (Page No.- 24)

4 Premium Insights (Page No.- 14)

4.1 Attractive Market Opportunities

4.2 Data Center Support Infrastructure Market

4.3 Market Across Segments

4.4 Market Across Various Regions

4.5 Market By Solutions

4.6 Life Cycle Analysis By Region

5 Data Center Support Infrastructure Market Overview (Page No.- 27)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Solution

5.3.2 By Service

5.3.3 By End User

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rising Data Center Demand

5.4.1.2 Maintaining Data Center Reliability

5.4.1.3 High Density And Efficient Data Centers

5.4.1.4 Cyber-Attacks And Threats

5.4.1.5 Increase In Data Traffic

5.4.2 Restraints

5.4.2.1 High Initial Investment

5.4.2.2 Compatible Infrastructure Solutions

5.4.3 Opportunities

5.4.3.1 Adoption Of Cloud Computing And Virtualization

5.4.3.2 Developing Solutions Compatible With Legacy Data Centers

5.4.3.3 Worldwide Increase In It Spending

5.4.4 Challenges

5.4.4.1 New Emerging Cooling Technologies

5.4.4.2 Modular Infrastructure Solutions

5.4.4.3 Use Of Renewable Source Of Power In Data Centers

6 Data Center Support Infrastructure Market Trends (Page No.- 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat Of New Entrants

6.3.2 Threat Of Substitutes

6.3.3 Bargaining Power Of Suppliers

6.3.4 Bargaining Power Of Buyers

6.3.5 Intensity Of Competitive Rivalry

6.4 Technological Standards

6.4.1 Introduction

6.4.1.1 American National Standards Institute (ANSI)

6.4.1.2 Telecommunication Industry Association (TIA)

6.4.1.3 National Electrical Manufacturers Association (NEMA)

6.4.1.4 Canadian Standards Association (CSA)

6.4.1.5 Underwriters Laboratory (UL)

6.4.1.6 Factory Mutual (FM) Approved

7 Data Center Support Infrastructure Market, By Solution (Page No.- 45)

7.1 Introduction

7.2 Power Support Infrastructure

7.3 Cooling Infrastructure

7.4 Security Infrastructure

7.5 Management Support Infrastructure

8 Data Center Support Infrastructure Market, By Service (Page No.- 59)

8.1 Introduction

8.2 Consultation Service

8.3 Professional Service

8.4 System Integration

9 Data Center Support Infrastructure, By Vertical (Page No.- 69)

9.1 Introduction

9.2 Telecom And It

9.3 Banking, Financial Services, And Insurance (BFSI)

9.4 Government

9.5 Healthcare

9.6 Energy

9.7 Others Vertical

10 Data Center Support Infrastructure, By End User (Page No.- 87)

10.1 Introduction

10.2 Cloud Provider

10.3 Colocation Provider

10.4 Enterprise

11 Geographic Analysis (Page No.- 95)

11.1 Introduction

11.2 North America (NA)

11.3 Europe

11.4 Asia-Pacific (APAC)

11.5 Middle East And Africa (MEA)

11.6 Latin America (LA)

12 Competitive Landscape (Page No.- 108)

12.1 Overview

12.1.1 Ecosystem & Roles

12.2 End-User Landscape

12.2.1 Market Opportunity Analysis

12.2.2 End-User Analysis

12.2.2.1 North American Colocation Market Is Expected To Grow By 15% Annually

12.2.2.2 Modular Data Center Is Setting New Benchmarks In Efficiency

12.2.2.3 The Space Required For Data Center Will Surpass By 500,000 Square Feet

12.2.2.4 Electricity Prices In The U.S. Is Expected To Rise More Than 21.35% In The Coming 10 Years

12.2.2.5 Mega Data Center Market Is Expected To Be Worth $20.55 Billion By 2019

12.2.2.6 The Converged Infrastructure Market Is Estimated To Reach $15.27 Billion By 2015

12.3 Competitive Suituation And Trends

12.4 New Product Launches

12.5 Agreements, Partnerships, Collaborations, & Joint Ventures

12.6 Mergers & Acquisitions

12.7 Expansions

13 Company Profiles (Business Overview, Products & Services, Key Insights, SWOT Analysis, Recent Developments, Mnm View)* (Page No.- 119)

13.1 Introduction

13.2 ABB

13.3 Eaton

13.4 Emerson Network Power

13.5 HP

13.6 Schneider Electric

13.7 Intel

13.8 Siemens

13.9 Hitachi

13.10 Raritan

13.11 Rittal

*Details On Business Overview, Products & Services, Key Insights, Swot Analysis, Recent Developments, MNM View Might Not Be Captured In Case Of Unlisted Companies.

14 Appendix (Page No.- 155)

14.1 Discussion Guide

14.1.1 Section 1 General Awareness

14.1.2 Section 2 Types Of Infrastructure

14.1.3 Section 3 Types Of Services

14.1.4 Section 4 End User

14.1.5 Section 5 Verticals

14.1.6 Section 6 Regional Markets

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List Of Tables (93 Tables)

Table 1 Global Data Center Support Infrastructure Market: Assumptions

Table 2 Data Center Support Infrastructure: Market,20142019 ($Billion, Y-O-Y %)

Table 3 Rising Data Center Demand Paving New Growth Avenues For Players In the Market

Table 4 High Initial Investment Is A Big Hurdle For Organizations Adopting New Support Infrastructure Solutions

Table 5 Cloud-Based Computing And Virtual Environments Will Pave New Opportunities In the Market

Table 6 Data Center Support Infrastructure Market Size, By Solution,20142019 ($Billion)

Table 7 Data Center Support Infrastructure: Market Growth, By Solution, 20142019 (Y-O-Y %)

Table 8 Data Center Power Support Infrastructure Market Size, By End User, 20142019 ($Million)

Table 9 Data Center Power Support Infrastructure Market Growth, By End User, 20142019 (Y-O-Y %)

Table 10 Data Center Power Support Infrastructure Market Size, By Region, 20142019 ($Million)

Table 11 Data Center Power Support Infrastructure Market Growth, By Region, 20142019 (Y-O-Y %)

Table 12 Data Center Power Support Infrastructure, By Type, 20142019 ($Million)

Table 13 Data Center Power Support Infrastructure, By Type, 20142019 (Y-O-Y %)

Table 14 Data Center Cooling Support Infrastructure Market Size, By End User, 20142019 ($Million)

Table 15 Data Center Cooling Support Infrastructure Market Growth, By End User, 20142019 (Y-O-Y %)

Table 16 Data Center Cooling Support Infrastructure Market Size, By Region, 20142019 ($Million)

Table 17 Data Center Cooling Support Infrastructure Market Growth,By Region, 20142019 (Y-O-Y %)

Table 18 Data Center Cooling Support Infrastructure, By Solution,20142019 ($Million)

Table 19 Data Center Cooling Support Infrastructure Market Growth,By Solution, 20142019 (Y-O-Y %)

Table 20 Data Center Security Support Infrastructure Market Size, By End User, 20142019 ($Million)

Table 21 Data Center Security Support Infrastructure Market Growth,By End User, 20142019 (Y-O-Y %)

Table 22 Data Center Security Support Infrastructure Market Size, By Region, 20142019 ($Million)

Table 23 Data Center Security Support Infrastructure Market Growth,By Region, 20142019 (Y-O-Y %)

Table 24 Data Center Management Support Infrastructure Market Size, By End User, 20142019 ($Million)

Table 25 Data Center Management Support Infrastructure Market Growth,By End User, 20142019 (Y-O-Y %)

Table 26 Data Center Management Support Infrastructure Market Size,By Region, 20142019 ($Million)

Table 27 Data Center Management Support Infrastructure Market, By Region, 20142019 (Y-O-Y %)

Table 28 Data Center Support Infrastructure Market Size, By Service,20142019 ($Billion)

Table 29 Data Center Support Infrastructure: Market Growth, By Service,20142019 (Y-O-Y %)

Table 30 Consultation Service Market Size, By End User, 20142019 ($Million)

Table 31 Consultation Service Market Growth, By End User, 20142019 (Y-O-Y %)

Table 32 Consultation Service Market Size, By Region, 20142019 ($Million)

Table 33Consultation Service Market Growth, By Region, 20142019 (Y-O-Y %)

Table 34 Data Center Support Professional Service Market Size, By End User, 20142019 ($Million)

Table 35 Professional Service Market Growth, By End User, 20142019 (Y-O-Y %)

Table 36 Professional Service Market Size, By Region, 20142019 ($Million)

Table 37 Data Center Support Professional Service Market Growth, By Region, 20142019 (Y-O-Y %)

Table 38 System Integrator Market Size, By End User, 20142019 ($Million)

Table 39 System Integrator Market Growth, By End User, 20142019 (Y-O-Y %)

Table 40 System Integrator Market Size, By Region, 20142019 ($Million)

Table 41 System Integrator Market Growth, By Region, 20142019 (Y-O-Y %)

Table 42 Data Center Support Infrastructure Market Size, By Vertical,20142019 ($Billion)

Table 43 Data Center Support Infrastructure: Market Growth, By Vertical, 20142019 (Y-O-Y %)

Table 44 Telecom And IT Market Size,By Solution, 20142019 ($Million)

Table 45 Telecom And IT Market Growth, By Solution, 20142019 (Y-O-Y %)

Table 46 Telecom And IT Market Size,By Service, 20142019 ($Million)

Table 47 Telecom And IT Market Growth, By Service, 20142019 (Y-O-Y %)

Table 48 BFSI Market Size, By Solution, 20142019 ($Million)

Table 49 BFSI Market Growth, By Solution, 20142019 (Y-O-Y %)

Table 50 BFSI Market Size, By Service, 20142019 ($Million)

Table 51 BFSI Market Growth, By Service, 20142019 (Y-O-Y %)

Table 52 Government Market Size,By Solution, 20142019 ($Million)

Table 53 Government Market Growth,By Solution, 20142019 (Y-O-Y %)

Table 54 Government Market Size,By Service, 20142019 ($Million)

Table 55 Government Market Growth,By Service, 20142019 (Y-O-Y %)

Table 56 Healthcare Market Size,By Solution, 20142019 ($Million)

Table 57 Healthcare Market Growth,By Solution, 20142019 (Y-O-Y %)

Table 58 Healthcare Market Size, By Service, 20142019 ($Million)

Table 59 Healthcare Market Growth, By Service, 20142019 (Y-O-Y %)

Table 60 Energy Market Size, By Solution, 20142019 ($Million)

Table 61 Energy Market Growth, By Solution, 20142019 (Y-O-Y %)

Table 62 Energy Market Size, By Service, 20142019 ($Million)

Table 63 Energy Market Growth, By Service, 20142019 (Y-O-Y %)

Table 64 Others Vertical Market Size, By Solution, 20142019 ($Million)

Table 65 Others Vertical Market Growth, By Solution, 20142019 (Y-O-Y %)

Table 66 Others Vertical Market Size, By Service, 20142019 ($Million)

Table 67 Others Vertical Market Growth, By Service, 20142019 (Y-O-Y %)

Table 68 Market Size, By End User,20142019 ($Billion)

Table 69 Market Growth, By End User, 20142019 (Y-O-Y %)

Table 70 Cloud Provider Market Size, By Region, 20142019 ($Million)

Table 71 Cloud Provider Market Growth, By Region, 20142019 (Y-O-Y %)

Table 72 Colocation Provider Market, 20142019

Table 73 Colocation Provider Market Size, By Region, 20142019 ($Million)

Table 74 Colocation Provider Market Growth, By Region, 20142019 (Y-O-Y %)

Table 75 Enterprise Market, 20142019

Table 76 Enterprise Market Size, By Region, 20142019 ($Million)

Table 77 Enterprise Market Growth, By Region, 20142019 (Y-O-Y %)

Table 78 Data Center Support Infrastructure Market Size, By Region,20142019 ($Billion)

Table 79 Data Center Support Infrastructure: Market Growth, By Region,20142019 (Y-O-Y %)Table 80 NA: Market Size, By Vertical, 20142019 ($Million)

Table 81 NA: Market Growth, By Vertical, 20142019 (Y-O-Y %)

Table 82 Europe: Market Size, By Vertical, 20142019 ($Million)

Table 83 Europe: Market Growth, By Vertical, 20142019 (Y-O-Y %)

Table 84 APAC: Market Size, By Vertical, 20142019 ($Million)

Table 85 APAC: Market Growth, By Vertical, 20142019 (Y-O-Y %)

Table 86 MEA: Market Size, By Vertical, 20142019 ($Million)

Table 87 MEA: Market Growth, By Vertical, 20142019 (Y-O-Y %)

Table 88 LA: Market Size, By Vertical,20142019 ($Million)

Table 89 LA: Market Growth, By Vertical, 20142019 (Y-O-Y %)

Table 90 New Product Launches, 20102014

Table 91 Agreements, Partnership, Collaborations, & Joint Venture, 20102014

Table 92 Mergers & Acquisitions, 20102014

Table 93 Expansions, 20102014

List Of Figures (66 Figures)

Figure 1 Data Center Support Infrastructure: Stakeholders

Figure 2 Market: Research Methodology

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Break Down Of Primary Interviews: By Company Type And Designation

Figure 6 Key Industry Insights

Figure 7 Data Center Support Infrastructure Market, 20142019, (Y-O-Y %)

Figure 8 The Service Segment Is Expected To Grow With A High Cagr Of 10.8%

Figure 9 Attractive Market Opportunities

Figure 10 Data Center Support Infrastructure, By Region

Figure 11 Global Market Share,By Segment, 2014

Figure 12 Global Market Across Various Region,2014

Figure 13 Management Solution Is Expected To Register The Highest Cagr

Figure 14 APAC And Mea To Unfold Huge Opportunities In Coming Years

Figure 15 Evolution Of Data Center Support Infrastructure

Figure 16 Market Segmentation:By Solution

Figure 17 Market Segmentation: By Service

Figure 18 Market Segmentation:By End User

Figure 19 Data Center Requirement In Future Will Affect The Demand For the Market

Figure 20 Value Chain Analysis (2014): Major Value Is Added During The Product Development Phase

Figure 21 Porters Five Forces Analysis

Figure 22 Power Solutions To Hold Major Share In the Market

Figure 23 Data Center Power Support Infrastructure Market, 20142019

Figure 24 Data Center Cooling Support Infrastructure Market, 20142019

Figure 25 Data Center Security Support Infrastructure Market, 20142019

Figure 26 Data Center Management Support Infrastructure Market, 20142019Figure 27 The Consultation Services Is Expected To Grow With A Highest Cagr Of 12.7%

Figure 28 Consultation Service Market, 20142019

Figure 29 Professional Service Market, 20142019

Figure 30 System Integrator Market,20142019

Figure 31 The Telecom And IT Is Expected To Hold The Highest Revenue In The Forecast Period

Figure 32 Telecom And It Market,20142019

Figure 33 BFSI Market, 20142019

Figure 34 Government Market, 20142019

Figure 35 Healthcare Market, 20142019

Figure 36 Energy Market, 20142019

Figure 37 Other Vertical Market,20142019

Figure 38 Colocation Providers Expected To Grow At A Highest CAGR In The Forecast Period

Figure 39 Cloud Provider Market,20142019

Figure 40 Highest Growth Is Expected In Apac Region

Figure 41 NA: Market, 20142019

Figure 42 Europe: Market, 20142019

Figure 43 APAC: Market, 20142019

Figure 44 MEA: Market, 20142019

Figure 45 LA: Market, 20142019

Figure 46 Companies Adopted Product Upgradation And Acquisition As The Key Growth Strategies Over The Last Three Years

Figure 47 ABB And Eaton Grew At The Highest Rate Between 2009 And 2013

Figure 48 Data Center Support Infrastructure: Ecosystem

Figure 49 Data Center Support Infrastructure Market Opportunity Plot

Figure 50 Data Battle For Market Share: New Product Launches Was The Key Strategy

Figure 51 Geographic Revenue Mix Of Top Five Market Players

Figure 52 ABB: Business Overview

Figure 53 ABB: Swot Analysis

Figure 54 Eaton Corporation: Business Overview

Figure 55 Eaton Corporation: Swot Analysis

Figure 56 Emerson Network Power: Business Overview

Figure 57 Emerson Network Power Swot Analysis

Figure 58 Hewlett-Packard: Business Overview

Figure 59 HP Swot Analysis

Figure 60 Schneider Electric: Business Overview

Figure 61 Schneider Electric Swot Analysis

Figure 62 Intel : Business Overview

Figure 63 Siemens: Business Overview

Figure 64 Hitachi Corporation: Business Overview

Figure 65 Raritan: Business Overview

Figure 66 Rittal: Business Overview

Growth opportunities and latent adjacency in Data Center Support Infrastructure Market